What Is Dollar Cost Averaging? A Beginner’s Guide

Dollar-cost averaging is a popular investment strategy that can help you grow your investment while minimizing loss. Here's everything you need to know.

Parcl Team

Aug 4, 2022

There's no shortage of personal finance advice and techniques to follow when it comes to investing. Unfortunately, despite what some of the "market experts" will tell you, there's no one strategy that will guarantee you massive financial wealth. There are, however, some time-tested investment strategies that can help put you in a position to grow your portfolio with minimal risk.

One such strategy is dollar-cost averaging, an effective way to grow your financial investments while protecting against the risk of significant loss. While it may not be the most growth-focused investment strategy out there, it is incredibly simple to follow and can help set you up for long-term investing success.

In this article, we'll cover everything you need to know about how dollar-cost averaging works, including its benefits and some examples of it in action.

What is dollar-cost averaging?

Dollar-cost averaging involves investing a sum of money (usually a relatively small amount) into one particular asset at regular intervals.

The entire premise of dollar-cost averaging is not to try and time the market. In a perfect world, you would always be able to purchase a stock or alternative investment at the absolute lowest price possible. We all have a friend or relative who seems to have that "knack" for knowing the perfect time to buy.

But given market complexities, timing the market is virtually impossible over a long enough time frame. Sorry, not even your best friend has a crystal ball.

As Charles Schwab notes on their blog:

"The best course of action for most of us is to create an appropriate plan and take action on that plan as soon as possible. It's nearly impossible to accurately identify market bottoms on a regular basis."

Let's look at how dollar-cost averaging works.

How exactly does dollar-cost averaging work?

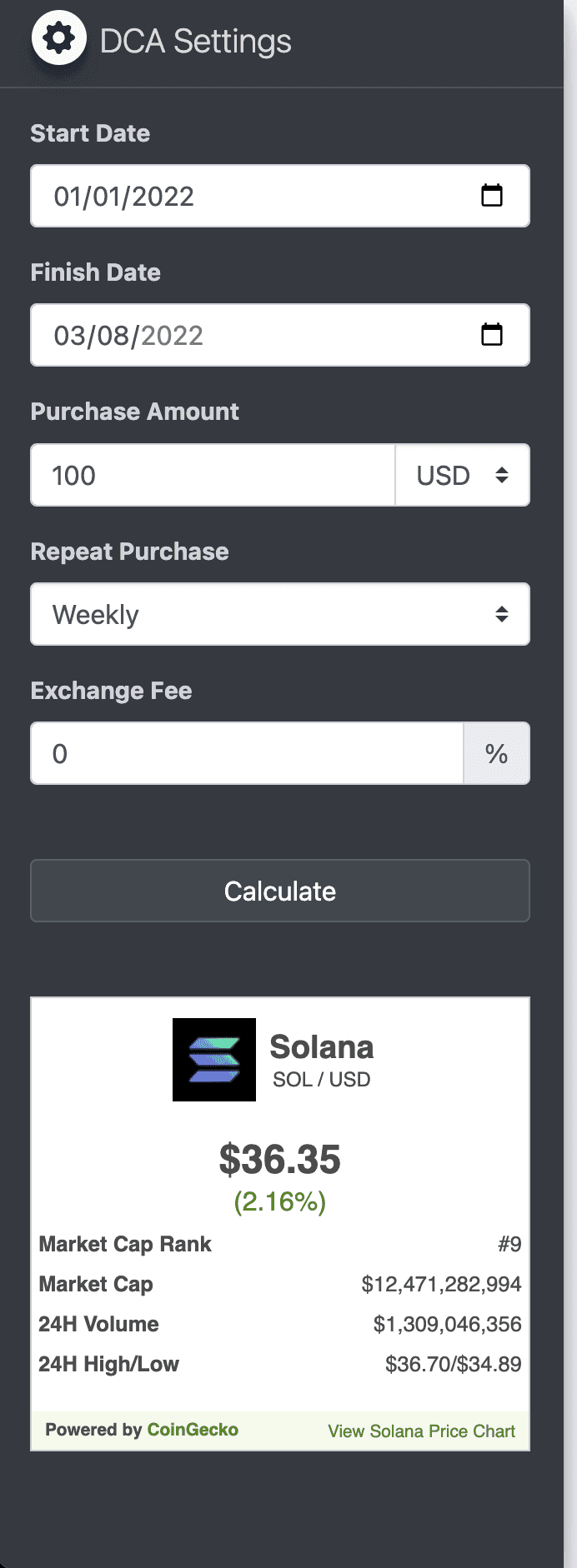

Let's say you are interested in investing in the cryptocurrency Solana (SOL) and want to add some to your portfolio. Let's also say, for this example, you have 1K USD to invest.

One strategy would be to make a single lump sum purchase of 1K USD in Solana. If Solana goes up 50% that week, you will be quite the happy investor. You could sell a portion of Solana and walk away with a reasonably sized profit. Of course, instead of Solana going up 50%, it could also swing the other way, leaving your initial investment barely a fraction of what it was.

Depending on your investor tolerance for risk, you might be interested in the lump sum method.

Alternatively, you could use dollar-cost averaging. Instead of investing your entire 1K USD in a single transaction, you decide to invest 100 USD each week into Solana over the course of 10 weeks.

Each week, you would add a small amount of Solana to your portfolio instead of buying as much Solana right away with a lump sum transaction. With DCAing, instead of trying to time the market, you commit to adding to your Solana holdings over time regardless of short term price fluctuations.

For this example, let's say you started cost averaging on January 1st, 2022, and ended March 8th, 2002— ten total investments of 100 USD.

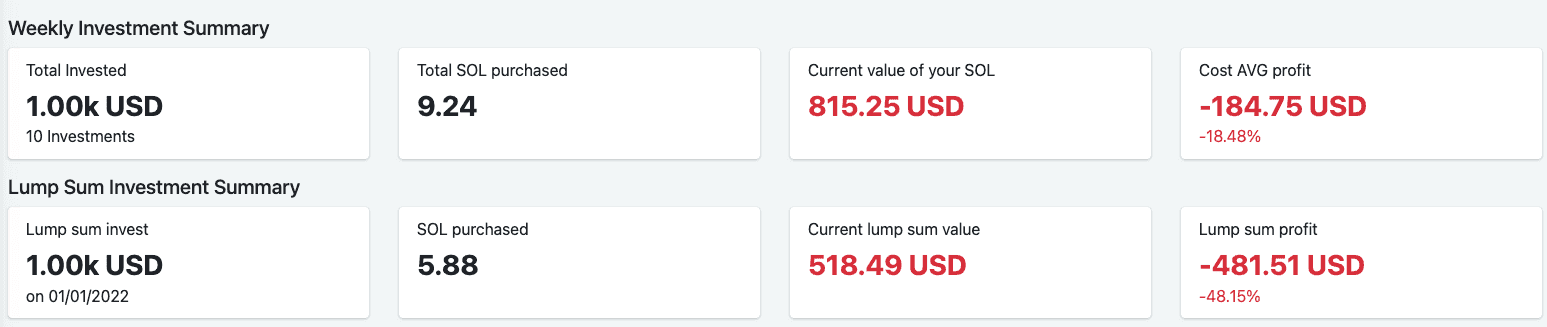

Here's how it would look.

Using the lump-sum strategy, your total value of Solana on March 8th would be 518.49 USD. Using the dollar-cost averaging strategy, the value of your Solana on March 8th would be 815.25 USD.

Quite a big difference!

While both strategies ended up in the red, your losses are significantly less with cost averaging.

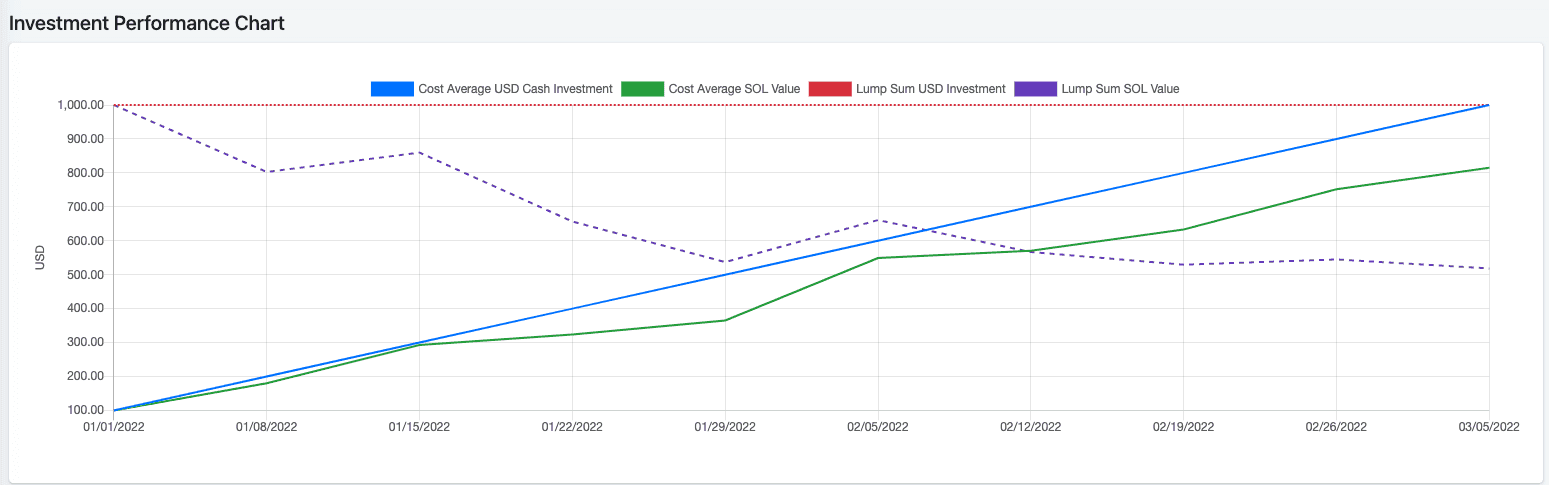

Here's how the two options compare in chart form.

Again, dollar cost averaging isn't foolproof. Any investor is susceptible to losses. But dollar-cost averaging is a strategy that can be helpful for anyone looking for a more passive investing strategy with relatively minimal risk.

4 benefits of dollar-cost averaging

1. Stress-free investing: With dollar-cost averaging, you don't need to be glued to your phone, stressing whether you're getting the best share price. Dollar-cost averaging can help you take the emotion out of investing—you literally "set it" and forget it. The entire strategy is automated whether you're investing in a mutual fund or individual stocks.

2. Reduced risk: Dollar-cost averaging, in general, helps reduce your overall risk, given you're buying over a prolonged period. Large swings in the market won't affect you as much, particularly from a loss perspective. Essentially, you’re choosing less potential profits for more stability.

3. Increased exposure: When you use dollar-cost averaging, you're getting exposure to your desired asset, even if it's in small dollar amounts, which again, helps you build your portfolio without worrying about the day to day price.

4. Minimal capital requirement: Because you're buying an asset at regular intervals regardless of the price, you don't need a large amount of money to get started. For example, at the time of this writing, one share of Tesla is about 700 USD.

Many investors just getting started may not have 700 USD at their disposal. With DCA, instead, you could purchase fractional shares of Tesla and work your way up to owning a full share over time. You can dollar cost average into the stock market, your 401 k, real estate, mutual funds, and even crypto.

2 downsides of dollar-cost averaging

Despite dollar-cost averaging being a popular strategy, it isn't the right strategy for everyone. Again, if you have a high tolerance for risk and are looking to maximize your portfolio at all costs, it's probably not the right option for you.

Here are a few other factors to consider before deciding to start dollar-cost averaging.

1. Lower upside: By design, you're going to have a much lower "upside" when you DCA compared to when you buy an asset in a lump sum. If you're looking to take advantage of significant swings and are willing to tolerate higher risk, DCAing might not be your best option.

2. Markets trend upwards over time: Historically, across the board, most markets trend upwards over the long term, meaning you will ultimately leave some 'profit' on the table compared to if you simply invested a lump sum.

Does dollar-cost averaging really work?

There's no denying that by investing a large sum of money into an asset at one time, you have the chance for a much higher return. That said, dollar-cost averaging is effective in doing what it was designed to do.

Instead of worrying every day as to whether or not to buy, you can choose an investment strategy that is more or less on autopilot.

You'll sometimes buy a little higher than you could have, but you'll also occasionally catch a really great deal when a stock or asset dips below normal levels. There's no fancy formula or calculus needed. It's really that simple.

Get started with dollar-cost averaging

The best advice for anyone looking into dollar-cost averaging is to start as soon as possible. Whether you want to DCA into Parcl, a mutual funds, or even stocks, it's a great option to consider. You can choose to invest, say, 10 USD in some fractional shares each week if that is aligned with your investing goals.

Better yet, you can automate this process so that you make the recurring purchase without having to make manually buy each time. If you're interested in applying dollar-cost averaging in your investing strategy for real estate, keep an eye on our upcoming Parcl launch.

In the meantime, check out these articles about physical and digital real estate:

How to invest in digital real estate

Dollar-cost averaging FAQ

Should you dollar cost average Bitcoin or other cryptocurrencies?

Because cryptocurrencies such as Bitcoin tend to have large price swings, dollar-cost averaging can be a great way to gain exposure to a relatively volatile asset. You can also DCA into a mutual fund, individual stocks, or even Parcels to have a more diversified investment portfolio.

How do I get started with dollar-cost averaging?

Choose a stock, mutual fund, or cryptocurrency to invest in.

Choose a dollar amount you feel comfortable investing regularly.

Decide the timeframe in which you want to deploy your funds.

Setup recurring purchases to automate the entire strategy.

Shared content and posted charts are intended to be used for informational and educational purposes only. Parcl does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages. For more information please see the terms of use.

Parcl Team