What is a Smart Contract

Let's cover the ins and outs of smart contracts from what they are, how they work, and where they're best used in a real environment.

Parcl Team

We at Parcl are committed to bridging the gap between mainstream and crypto — to start our mission, we are publishing a series of Blockchain Basics to help a broader group of people understand the innovation in this space.

In short, smart contracts are agreements written in code between two parties. Smart contracts are built and stored on decentralized blockchains and are impossible to tamper with.

There are plenty of blockchain projects out there working to develop smart contract platforms, such as Solana and Ethereum.

To put it plainly, smart contracts are important because they remove centralized middlemen in contexts that require trusted third parties to help facilitate value transfer, such as a clearing house that facilitates trading between buyers and sellers. Relative to smart contracts, middlemen waste significant time and money as well as create centralized points of failure.

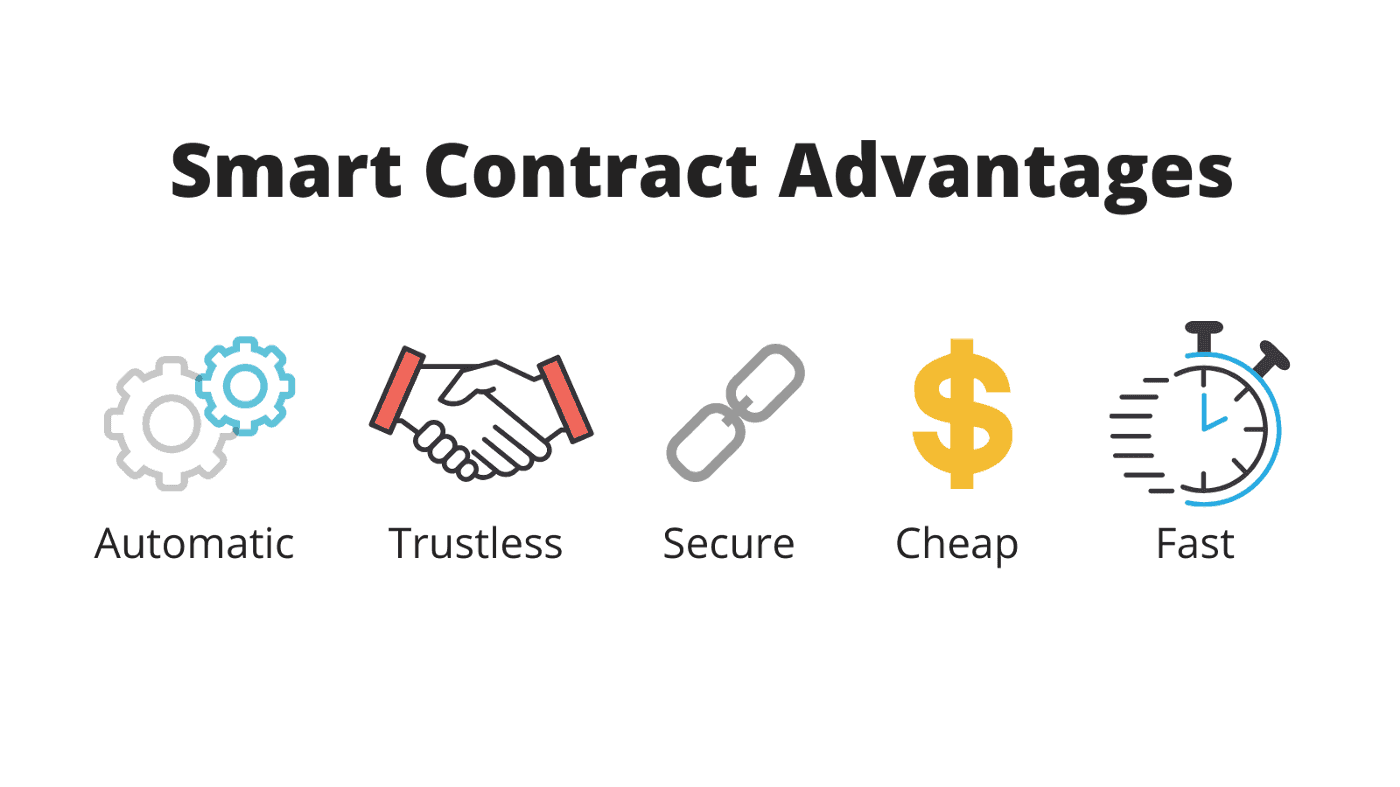

Benefits of Smart Contracts

Smart contracts provide security, transparency and can remove layers of bureaucracy in certain contexts.

Smart contracts offer large systems and institutions a credible means of simplifying the amount of coordination needed to contract with third parties. In the next section, we explain some of the benefits of smart contracts.

Autonomous

Smart contracts do not require centralized facilitators. Once the code is written and executed, no other action is required. This feature likely removes many costs involved in business processes today, such as many arbitration systems and value transfer systems.

Trustless & Secure

Carrying out transactions between multiple parties doesn’t require you to trust the other party because the smart contract code deterministically enforces the rules of the contract.

Nonetheless, security is still a concern because the logic of a smart contract could be incorrect. This is why it is typical for smart contracts to be carefully audited by security experts before deployment onto the blockchain. If the contract’s logic is correct, then its code can execute trustlessly and the results of any execution will be verifiable and immutable.

Cheap & Fast

The removal of long processes will decrease admin and labor costs; most importantly, it could remove specific functions of institutions, such as insurance companies and banks.

In turn, the more large institutional intermediaries that are replaced with lightweight code, the faster and cheaper an average transaction will be across industries.

Example Use Cases

Travel Insurance

If you are going on vacation and took out flight insurance using a smart contract, and your flight got canceled, that contract could be executed to determine if your claim should be paid out. Since your flight was canceled and this is easy to prove, the smart contract would likely pay out your claim immediately.

Suppose you take out an insurance policy using a current day insurance company. In that case, the insurance company would evaluate your claim and can decide whether or not to pay you or begin some sort of investigative process that consumes time and resources.

Mortgages

Another example of how smart contracts can be used in the real world is in the approval of mortgages.

If you are a homeowner or broker, you know better than anyone that mortgages can take up to two months to approve.

Smart contracts could significantly reduce this time to just a few days if the person seeking the mortgage has all the relevant information and meets the parameters of a smart contract that writes mortgages.

Parcl Smart Contracts

Parcl uses multiple smart contracts across its synthetic real estate protocol and token swapping protocol. Prices of pAssets–tokens that represent price per square foot in a given geographic area–are determined using the Parcl protocol’s property valuation database.

Traders use the Parcl AMM smart contract to trade pAssets. The contract custodies tokens and facilitates token swaps as opposed to a centralized trading company performing value transfer and custody.

Similarly, pAssets are created, or minted, when users deposit collateral into a vault against which they can mint pAssets. The contract ensures that a vault cannot mint more pAssets than it has collateral to back the pAssets according to a risk parameter set by the protocol.

The process of evaluating collateral and pAsset dollar values to assess the risk of minting new pAsset tokens is all handled via smart contract logic that underwrites and manages the risk as well as handles internal accounting of debts.

Follow us

🌐 Join our Waitlist: https://parcl.co

🐤 Twitter: https://twitter.com/Parcl

🏡 Discord: https://discord.gg/zWxp2JupNA

Parcl Team