Getting Started: How to Short Real Estate Markets on the Parcl Protocol

The Parcl Protocol is finally here! Here’s everything you need to know about getting short exposure on the Parcl Protocol.

Parcl Team

Sep 13, 2022

Caution: short selling entails greater risk, including, but not limited to, risk of unlimited losses and/or liquidation of debt positions, and is not suitable for all users. Please consult your financial advisor and/or assess your financial circumstances and risk tolerance before participating in riskier strategies such as short selling.

The information provided herein is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages incurred on the Parcl Protocol or elsewhere. Please see further disclosures below.

Welcome to the Short Exposure guide. In order to get short exposure on the Parcl Protocol, you follow many of the same steps outlined in the How to Borrow on Parcl and How to Trade on Parcl guides, with a few slight adjustments and nuances.

The Parcl Borrow feature allows Parcl Protocol users to borrow Parcls using USDC as a collateral asset. This creates an over-collateralized synthetic short position. To minimize your committed capital (improve capital efficiency of the trade) you can then swap your borrowed Parcl(s) in the Trade app in exchange for USDC, at the AMM price (based on slippage & other factors).

This creates a natural short position, with the effective capital committed being whatever over-collateralization ratio you selected in the borrowing process when opening the Parcl vault. The resulting capital commitment is not dissimilar to a ‘maintenance margin’ one might find utilized on a derivatives exchange.

This also creates market risk, as in order to close out the position, you either need to swap back USD for the given Parcl at the prevailing AMM price (based on slippage & other factors), or meet any vault position health requirements depending on the movement of the underlying oracle price. If vault position health is not maintained, the original borrow position risks liquidation.

Why Get Short Exposure via the Parcl Protocol?

There are several reasons a user may want to establish a short position in a given Parcl market:

They may have a (negative) directional view on the price trajectory of the underlying Parcl Price Feed oracle price based on real estate market observations.

They may be hedging long exposure via other assets including on the ground property ownership.

They may be interested in making a relative value bet - for example long Miami, short Manhattan (see the Trade guide for details on how to open the long side of the trade).

They may be performing an arbitrage around a deviation of the AMM price from the underlying Parcl Price Feed oracle price.

So how does a trader express a short trade? Let’s start from the top:

Getting Started

Before you can express a short trade on the Parcl Protocol, you’ll need to use the Borrow feature. But before you use the Borrow feature, you’ll first need a Solana wallet; we recommend Phantom. If you need help getting started, be sure to check out “How To Set Up Phantom” as well as our analysis on the top 5 Solana crypto wallets.

You’ll also need to fund your wallet with your desired amount of USDC to be used as collateral.

How To Borrow On the Parcl Protocol

The Parcl Borrow feature allows you to borrow Parcls based on your deposited USDC collateral. If you have USDC and would like to get exposure to the real estate markets using Parcl, the Borrow feature is for you.

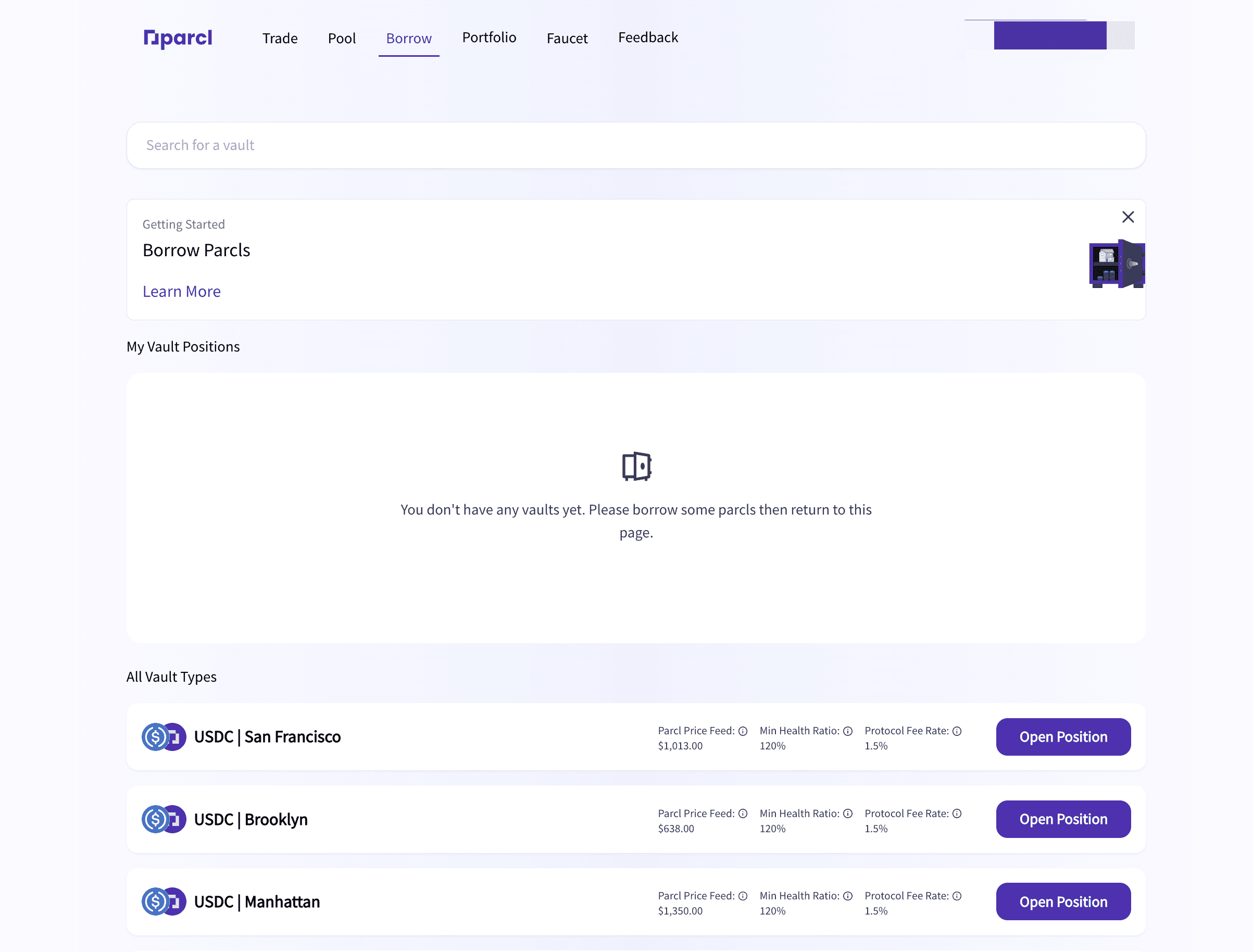

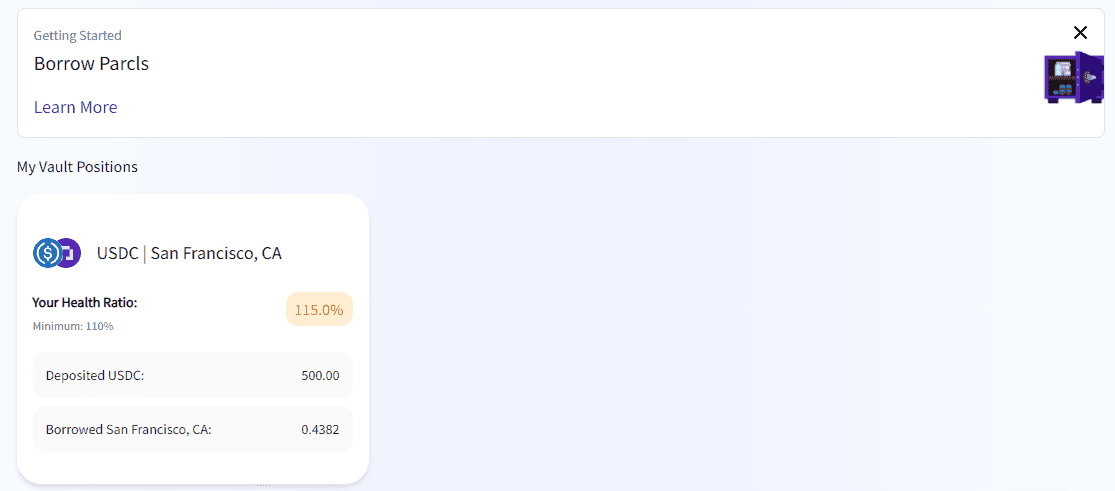

Here is the Borrow page.

At the top, you’ll see your current vault positions. Below you’ll see the many types of Borrow options available.

Here’s an example of opening a position for USDC | San Francisco position.

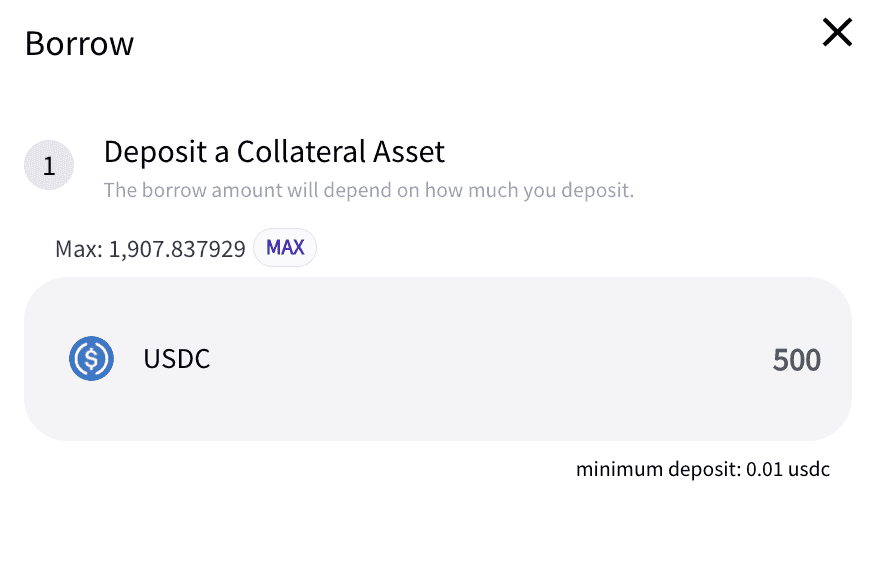

Clicking “Open Position” will bring you to the Borrow module

1. Deposit your USDC

Select the amount of USDC you would like to use as collateral. Your available USDC is based on the amount of USDC you hold in your Solana wallet. In this example, there is $500 USDC being used as collateral.

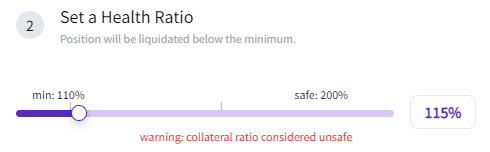

2. Set your Health Ratio

Using the slider, choose your desired Health Ratio for the specific position.

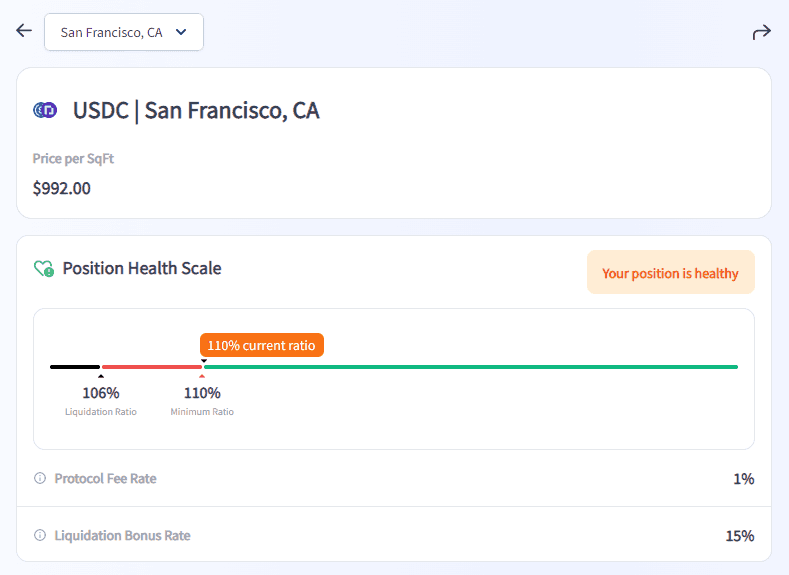

The Health Ratio is the minimum USD ratio of collateral to Parcl token debt allowed for a specific vault configuration.

If your vault position's health falls below the minimum collateral ratio, then you enter a buffer zone where you can deposit more collateral or repay debt because those actions make your vault position more healthy, but you can no longer borrow or withdraw because those actions make your vault position less healthy.

If your health ratio falls below the liquidation ratio, which is even lower than the minimum collateral ratio, then you will be partially liquidated to bring your vault position back to a healthy ratio.

Sliding to the right will lessen the risk of your position. As always, please discuss any positions with your financial advisor, and do not invest more than you can afford to lose.

The Borrow feature is encouraged to be used by experienced traders only*

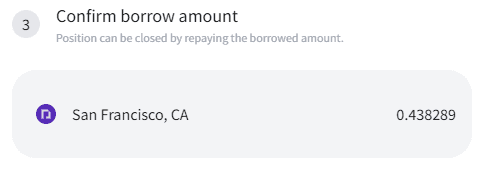

3. Confirm your Borrow amount

Once you’re happy with the amount of USDC you would like to use as collateral as well as your Health Ratio, click “Borrow” and confirm your transaction.

Upon approving your transaction, you will now see your Open Position under the “My Vault Positions” on the Borrow page. At a glance you can see your Health Ratio, amount of deposited USDC, and how much you’ve borrowed.

Clicking an individual vault card will bring you a more detailed look at your position. In this example, you’ll notice there is 110% current ratio which falls under the “healthy” category.

At the top you can see the current price per SqFT

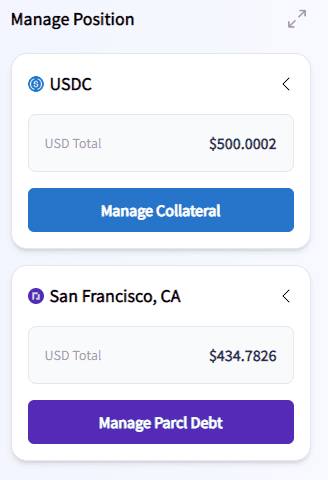

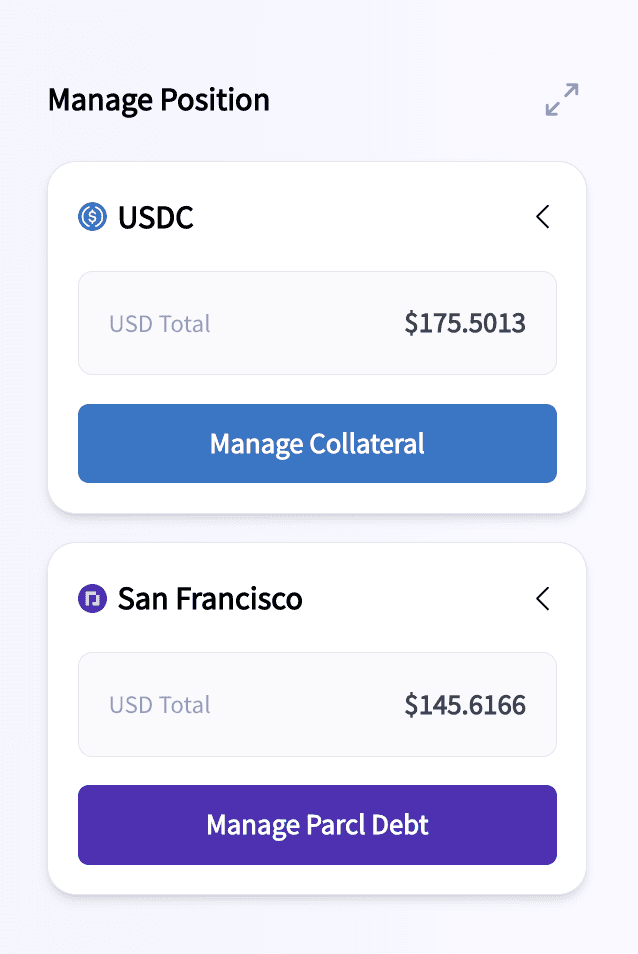

And on the right, you can manage your collateral or manage your debt at any time.

You can always deposit more collateral (USDC) but you can only borrow and withdraw the max amount that would keep your health ratio above or equal to the minimum collateral ratio. You can only repay up to the max Parcl token debt you owe with the specific vault position.

Congratulations, you used the Parcl Borrow feature successfully! Now, to execute that short trade…

Trading with the Parcl Protocol

To execute your short trade on your desired city or neighborhood Parcl market, head on over to the Trade page and ensure your Solana wallet remains connected.

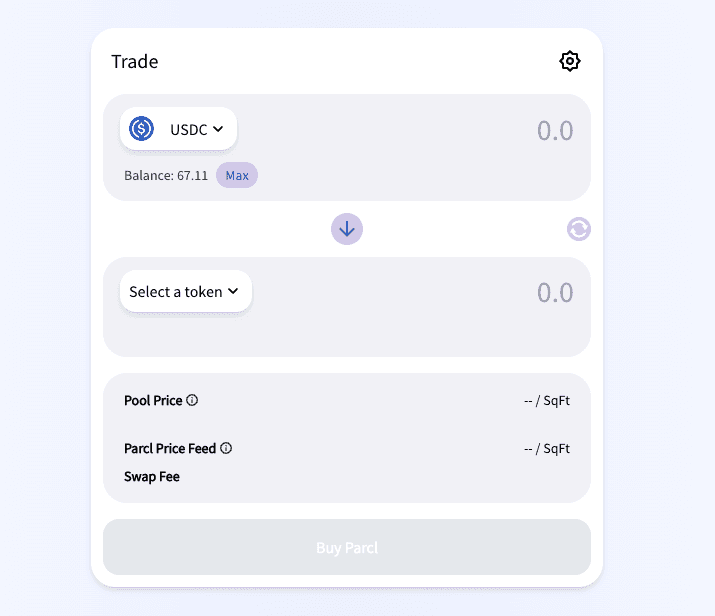

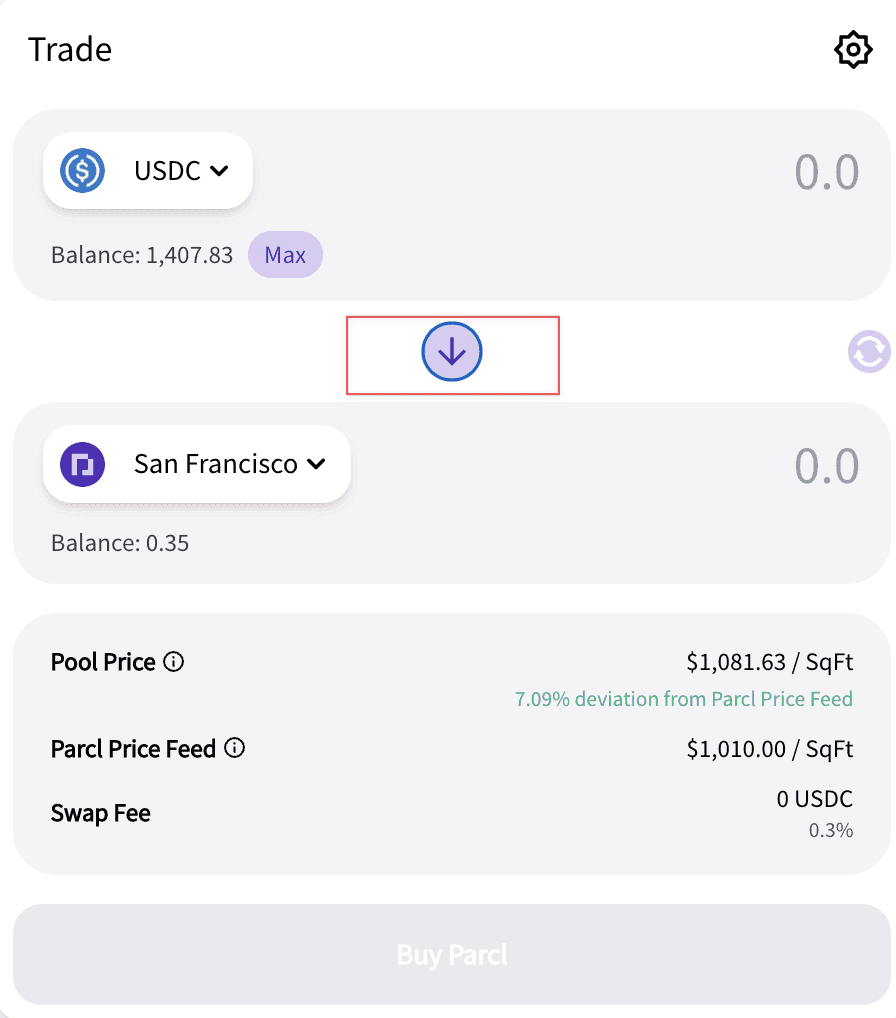

Here you’ll see the Parcl Trade module in its default view.

If you’ve ever used the likes of Uniswap, Raydium, or another decentralized exchange, things should look quite familiar.

At the top you will see your USDC balance. Below your USDC balance, you’ll find the option to select which Parcls you’d like to trade.

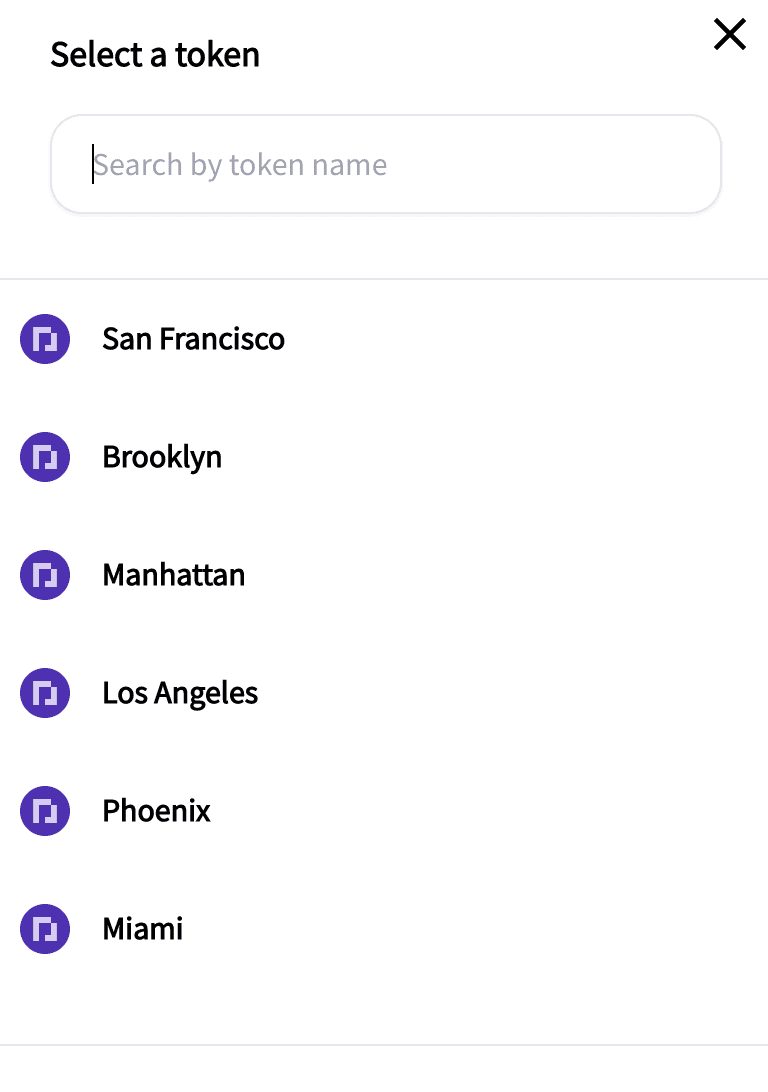

Currently, there are six North American Parcls to choose from:

San Francisco

Brooklyn

Manhattan

Los Angeles

Phoenix

Miami

Greater New York Parcl [Coming Soon]

Williamsburg Parcl [Coming soon]

Upper East Side Parcl [Coming soon]

TriBeCa [Coming soon]

Below, “select a token” you’ll see the Pool price, Parcl Price Feed, and Swap feed.

Pool Price is the current AMM price for your chosen Parcl.

Parcl Price Feed is the USD price per sq ft from the oracle.

Swap fee is .35% in USDC.

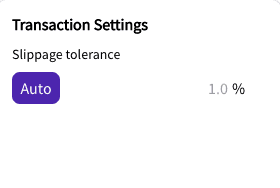

By clicking the settings icon (the gear at the top right), you can also adjust your slippage tolerance (recommended for experienced traders only.)

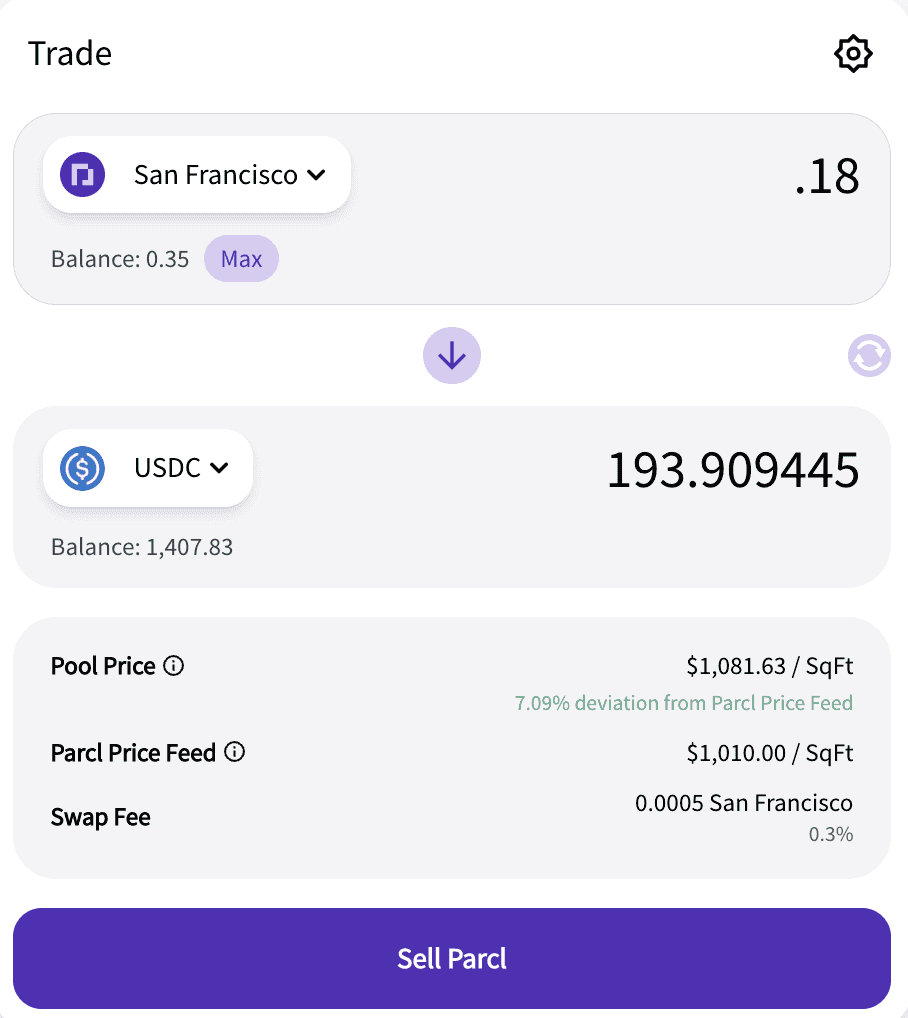

Let’s take a look at an example of a sale swap (outright sale or, in this case, a short trade). First, click the arrow in between the two ovals to change to a ‘sale’ view.

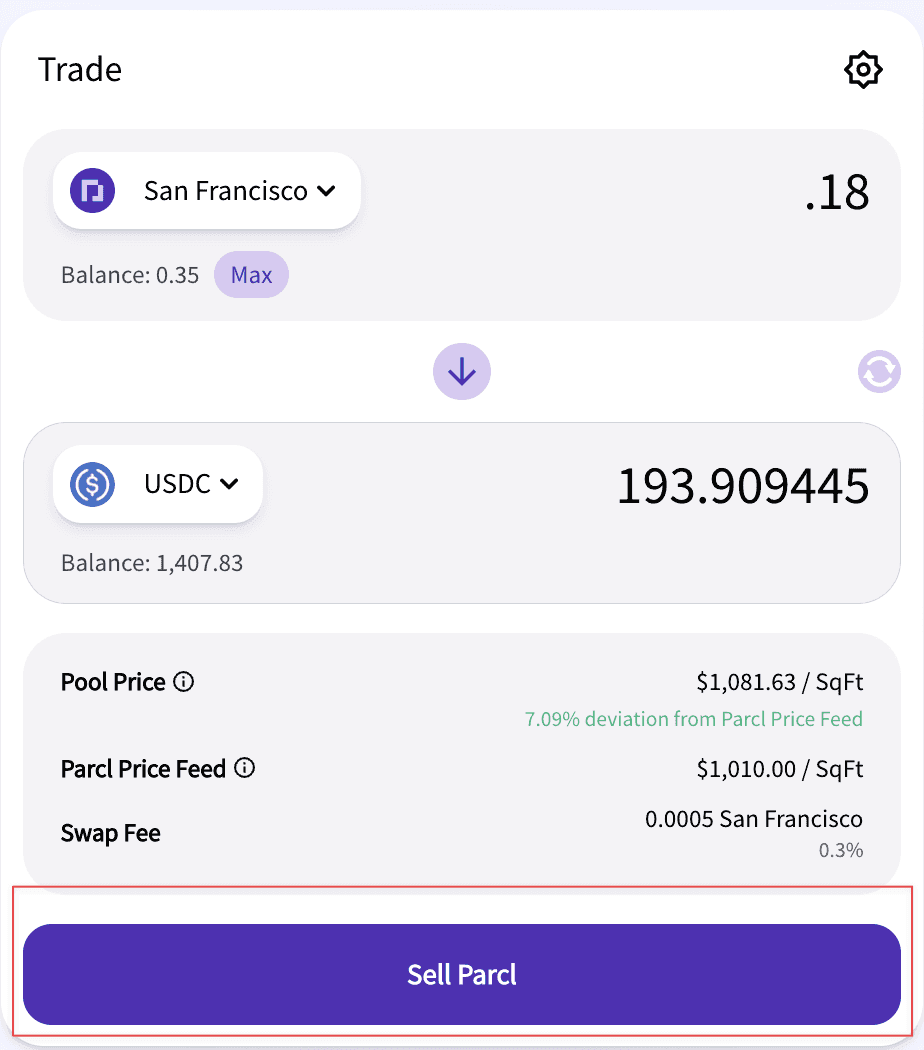

In this example, there’s a trade of a .18 stake of 1 San Francisco Parcl for 193.90445 USDC. A unit of 1 (one) Parcl represents exposure to 1 sq ft of that location.

Click “Sell Parcl” and approve the transaction in your Solana wallet. Assuming there is sufficient liquidity, you’ll receive a confirmation via your Solana wallet that the transaction executed on-chain.

Congratulations, you now have short exposure to synthetic real estate markets via Parcl. You can now benefit from declines in the price of the Parcl market you’ve borrowed against.

Conversely, should the price of the relevant Parcl Price Feed oracle appreciate, you may need to deposit incremental USDC to maintain the health of your collateralization ratio or repay your vault by repurchasing the Parcl you sold at the prevailing AMM price.

Should the health of your position deteriorate below a relevant liquidation ratio, you may be liquidated. Please find more information on this process here. Please see the risk disclosure at the beginning of this page to understand the risks associated with borrow & short activity.

Assuming your position remains healthy, you can swap back your USDC for the Parcl you sold at any time, at the prevailing AMM price (subject to slippage and other factors), in order to repay a healthy vault previously opened in the Borrow tab.

To repay your outstanding position at any time:

Click “Borrow” at the top of the page.

Under “My Vault Positions” click your desired position you wish to repay.

On the right hand side, click “Manage Parcl Debt”

As a reminder, to view your portfolio, simply click “Portfolio” and you’ll see an up-to-date look at your portfolio performance. To view your Borrowed positions simply click “Borrow” and you’ll see an up-to-date view of your borrowed Parcls and key stats such as health ratios.

Questions? Need help? Be sure to follow Parcl on Twitter and join the Discord for more on the latest Parcl news and developments.

If you’re looking to Trade or Pool with Parcl, be sure to check out the additional Parcl guides here:

How to Trade on the Parcl Protocol

How to Pool on the Parcl Protocol

Shared content and posted charts are intended to be used for informational and educational purposes only. Parcl does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages. For more information please see the terms of use.

Parcl Team