Why invest in real estate?

Why invest in real estate? Here are six reasons to consider adding real estate to your investment portfolio.

Parcl Team

Aug 1, 2022

When it comes to investing your hard-earned money, there's no shortage of options to consider. While investing in the stock market and 401K are some of the common and well-known options—real estate investing is an excellent option for many to consider, given its historically strong returns and many additional benefits it provides.

If you're on the fence about investing in real estate or unsure why it can be a potentially great investment, in this article, we cover 6 reasons why real estate should be on your investment radar.

Why invest in real estate? 6 reasons to invest

1. People always need homes

While no market is entirely immune to price fluctuations, real estate will always be needed. Whether in a bull market or recession, people worldwide will always need shelter, which is why real estate can often provide such great returns.

Because the need for homes will continue to remain, real estate is generally considered a safe investment compared to other assets that might be more volatile. While real estate prices can be affected by a severe global economic recession, the returns have proven to be steady over the long term.

Ultimately, investing in real estate gives you the potential ability to profit by providing something that everyone needs. There's very little chance of real estate going out of style anytime soon, and that's exactly what you should be looking for in your investments.

Especially relevant to recent market conditions, real estate is an effective way to bring stability to your investment portfolio during down markets across the board.

2. Real estate investing allows you to diversify your investments

While the wise saying "Never put all your eggs in one basket" can apply to virtually any area of your life, it's particularly relevant in investing. The best investors know that diversification is key to reliable long-term gains. Chasing high-risk, high-reward gains is a suitable strategy for some, but a more stable portfolio can bring you peace of mind.

Investing in multiple assets can help ensure you're not overexposed to any particular investment. Diversification is one of the most effective ways to ensure you reduce your potential losses without sacrificing too much potential gain.

If you only invest in the stock market, for example, your entire portfolio and net worth are affected when the stock market goes down.

Even in real estate, there's an opportunity to diversify as well. Whether investing in digital real estate, REITs, or commercial real estate, there's something for everyone.

"Being disciplined as an investor isn't always easy, but over time it has demonstrated the ability to generate wealth, while market timing has proven to be a costly exercise for many investors," says Ann Dowd, CFP®, vice president at Fidelity Investments on the Fidelity blog.

Diversification may reduce your overall returns in the short term, but it's a great way to plan for the future and be protected against a potential "black swan" event. In "bear marketers" having a diversified portfolio that includes real estate can help ensure you don't lost a signifiant portion of your investing portfolio.

3. Real estate provides historically strong returns

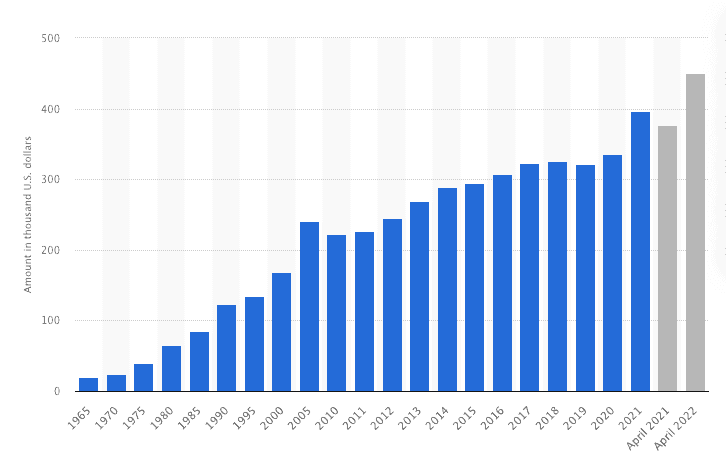

Over the long term, real estate investments have proven time and time again to provide historically strong returns. While investing in the stock market such as the S&P 500 can also generate considerable returns, it's much more exposed to wild price swings.

While there have been a handful of real estate market crashes over time, you're less likely to lose a large portion of your investments through real estate compared to other options such as the stock market.

If you're looking for a long-term investment that has history on its side, real estate can be a great addition to any modern investment portfolio.

4. Real estate can provide additional cash flow

In addition to providing consistent and reliable returns over the long run, real estate investments are a great opportunity to generate cash flow. Just as some stocks give you dividends, owning real estate can generate considerable cash flow and income which can help pay for living expenses or be invested further.

While the type of real estate you invest in determines the level of "passive income," there are multiple ways to invest, depending on your specific investing goals.

Although you do have to factor in the cost of maintenance of rental properties etc., in the case of rental properties, for example, the cash flow real estate provides remains appealing to a large portion of investors. Reinvesting your rental income is a great way to grow your own portfolio.

Cash flow from your real estate investments can oftentimes replace your regular income, allowing you more flexibility in your life and career.

5. Tax advantages for real estate investing

The potential tax advantages of real estate also make this type of investment all that more appealing. While these tax advantages depend on various factors, such as where you live, there are quite a few tax benefits at your disposal.

Real estate write-offs

In many cases, you can write off a portion of your real estate expenses and investments. For starters, you can write off property taxes, mortgage interest, and even property management fees. If you're looking to lower your tax bill, investing in real estate can be a great way to do it.

Capital gains

Because real estate is frequently viewed as a long-term investment, you can usually benefit from capital gains if you hold your investments for more than one year. Long-term capital gains on real estate are generally in the range of 15-20% instead of 30% or higher for short-term investments.

Self-employment

In most cases, those who invest in real estate can also benefit from tax advantages that come from self-employment or running a business. For rental properties specifically, income isn't taxed as 'earned income,' which can ultimately reduce your tax liability and improve your overall net worth.

6. Real estate investments often appreciate over time

In addition to the many benefits mentioned above, real estate investments generally appreciate over time. Unlike when you buy a car, which loses a significant amount of value the second you drive it off the lot, real estate investments can gain a substantial amount of value over time. Strategically upgrading or improving your investment properties can further improve the chances of appreciation as well.

That isn't to say real estate prices only go up, but with a long-term investment horizon, plenty of money can be made in real estate.

Best of all, many real estate investors find the entire process fun and engaging! Maybe you enjoy knowing which U.S. cities have generated the highest return on investment. Perhaps you're looking to purchase a second home in Florida to generate rental income. Real estate truly can be one of the best investments you ever make.

Conclusion

Despite the many benefits that investing in real estate provides, there are a few downsides. For one, it can take significant amounts of capital to get started in real estate, which unfortunately many folks are unable to do.

This is especially concerning, given that among millennials, “65% identified homeownership as a top sign of success. That number fell to 59% for Gen Zers — still a large figure, and neck-and-neck with that generation’s top choice of having a successful career (60%). “Furthermore, it’s not always easy knowing where to start. What kind of properties should you buy? Should you invest in commercial or residential?

Despite the downsides, real estate investing remains one of the best options to invest your money. Which is why here at Parcl, we're working to help make real estate investing accessible to everyone.

Shared content and posted charts are intended to be used for informational and educational purposes only. Parcl does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages. For more information please see the terms of use.

Parcl Team