What is Impermanent Loss

Impermanent loss happens when you provide liquidity to a liquidity pool and the price of the crypto assets that you deposit changes compared to the price you deposited them at.

Parcl Team

Aug 11, 2022

As decentralized finance and crypto continues to become more mainstream, there's been an increase in ways for investors and traders to earn through crypto beyond simply trading.

One popular method to earn with crypto is what's known as liquidity providing or (LP.) Liquidity providers can earn trading fees by becoming what is known as an automated market maker or AMM.

Essentially, liquidity providers stake a roughly equal amount of two crypto assets and earn fees based on the trading volume of those pairs. Liquidity providers play an essential role in decentralized finance and help ensure traders are able to buy and sell at any given point in time using a decentralized exchange.

By providing liquidity, traders can generally earn a competitive interest rate on their staked holdings.

So what's the catch?

Well, it's a thing called impermanent loss, and everyone who plans on providing liquidity in liquidity pools needs to understand it.

In this guide, we'll cover what impermanent loss is and how to ensure you get the most value out of providing liquidity.

What is Impermanent Loss?

Impermanent loss is most relevant to more experienced traders hoping to earn trading fees by providing liquidity.

But what exactly is impermanent loss?

Impermanent loss refers to the potential loss of assets as the result of a staked token price rising or falling after you deposit it in a liquidity pool.

Depending on the price fluctuations of the assets you staked, you may have slightly less of one of the assets depending on the market prices at the time. What this means is, you may be at risk of losing money despite earning trading fees from providing liquidity to decentralized exchanges.

While you can generally unstake your liquidity pool position at anytime, you won't always receive the exact the exact quantity of the tokens you staked depending on the price fluctuations of the assets you staked. If you stake A/B and tokens and B is traded a considerably higher volume than A, you are at risk of losing a small amount of B as the result of your providing liquidity.

"The percentage of a liquidity provider's participation in a pool is also substantial because when a liquidity provider commits or deposits their assets to a pool via a smart contract, they will instantly receive the liquidity pool's tokens. Liquidity providers can withdraw their portion of the pool (in this case, 20%) at any time using these tokens. So, can you lose money with an impermanent loss?

This is where the idea of IL enters the picture. Liquidity providers are susceptible to another layer of risk known as IL because they are entitled to a share of the pool rather than a definite quantity of tokens. As a result, it occurs when the value of your deposited assets changes from when you deposited them."

The larger the change in price, the higher the risk of impermanent loss. The loss being a reduction in value of your staked A and B tokens from the point of deposit to when you withdraw.

The effects of impermanent loss ultimately depends on the type of coins you're trading with; if pools contain assets that remain within a small price range, they'll be less likely to experience impermanent loss; stablecoins are good examples of this as they remain within very tight price levels.

So why would you want to provide liquidity if there's a chance you will experience impermanent loss?

Well, the trading fees that liquidity providers receive can be worth the risk as protocols such a Uniswap charges 0.3% per trade, which goes directly to the LPs (liquidity providers), ultimately counteracting the downside to being exposed to impermanent loss.

Impermanent loss doesn't mean providing liquidity is not worth the risk, but it is important to understand the dynamics of IL to ensure you're maximizing the value of liquidity providing.

How Does Impermanent Loss Happen? An Example of Impermanent Loss

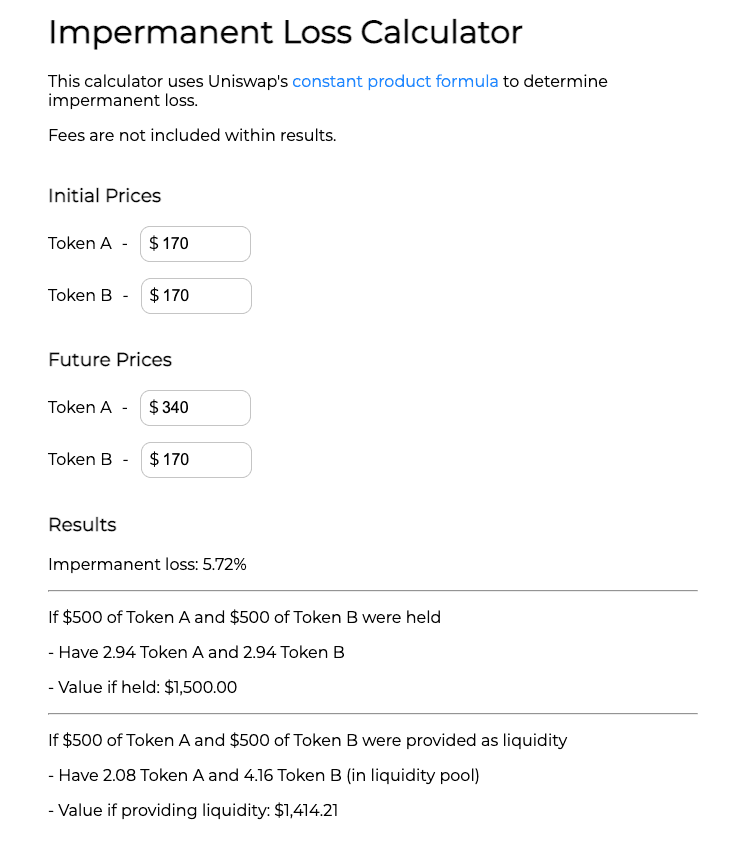

Let's say you decide to provide liquidity to a USDC/ETH liquidity pool and deposit 170 USDC and .1 ETH (roughly equal value at the time of this writing.)

Other investors of this specific liquidity pool have deposited a total of 1530 USDC and .9 ETH into the liquidity pool, which means that you have provided liquidity for roughly 10% of the pool, bringing the overall liquidity value to about 1 ETH, or 1730 USD.

Let's also say that the price of ETH doubles within a couple of weeks after you begin providing liquidity.

If you decide to withdrawal your original position of equal parts USDC and ETH , you will likely get slightly less ETH than you originally deposited given it was traded at a higher volume.

As such, your reduced ETH position would ultimately cost you profit despite you earning fees.

Here's how it would look with the Impermanent Loss Calculator below.

It's also important to note that impermanent loss happens regardless of the direction the market moves; it only cares about the price ratio relative to the time of deposit.

While fully understanding impermanent loss can get a little technical, ultimately what you should know is that through swings in prices of your staked assets, you could end up losing part of a token that is worth more than the trading fees you've been able to earn.

At the most basic level, impermanent loss is the opportunity cost of staking two assets that may go up or down in price while your position is open.

If you'd like to see a visual guide on impermanent loss, check out this video.

Be sure to also check out the guide to AMM and liquidity pools.

Shared content and posted charts are intended to be used for informational and educational purposes only. Parcl does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages. For more information please see the terms of use.

Parcl Team