What happens in a recession to real estate?

Is a recession a good time to invest in real estate? Here’s how recessions have historically impacted the real estate market.

Parcl Team

Sep 13, 2022

Real estate is one of the most common forms of alternative investments for the modern investor.

Investing in real estate allows you to diversify your portfolio, can provide additional cash flow, and has historically strong returns compared to stocks and other investment options.

And yet, with the global economy facing an uphill battle over the last several years, it’s important to understand how a recession impacts real estate investors and housing prices.

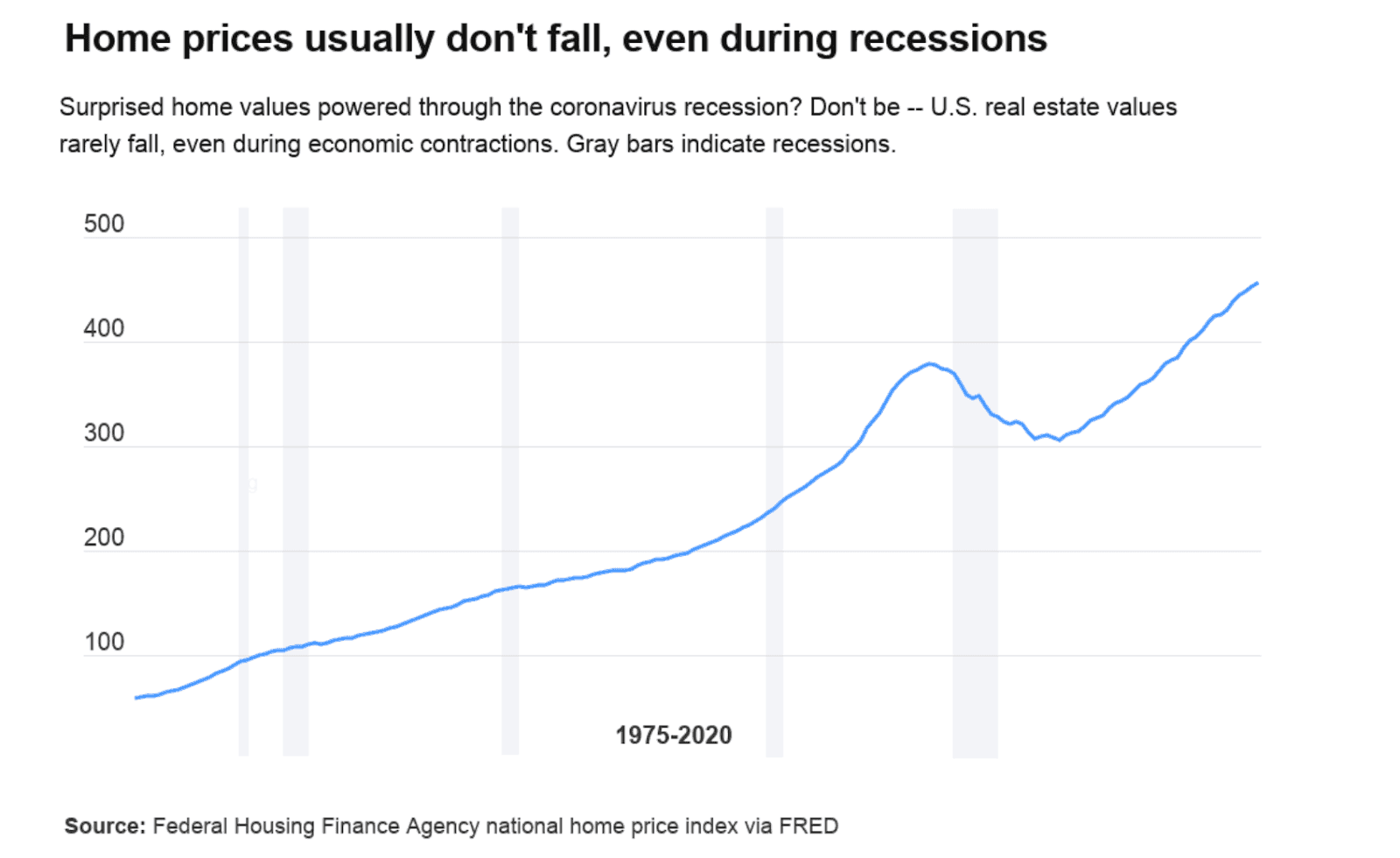

Generally speaking, housing prices do fall during a recession, but the extent to which they do is often overstated. As Odeta Kushi, deputy chief economist at title insurance company First American, explained it to The Balance:

“House prices clearly declined significantly during the Great Recession, but in other modern recessions, house price appreciation hardly skipped a beat, and year-over-year existing-home sales growth barely declined,” Kushi said.

“The reality is home prices and existing home sales don’t necessarily decline just because of a recession. In fact, the housing market actually benefits in one specific way during a recession: Monetary policy is usually eased to boost the economy, often leading to falling mortgage rates, which increases consumer homebuying power and makes homes more affordable.”

In turbulent times, real estate specifically, is known to be a great hedge against inflation due to the fact it has historically been able to keep up with the rising costs brought on by a recession.

Because shelter is always in demand regardless of the economy, having real estate in your portfolio can help keep your investments balanced regardless of market conditions.

Of course, real estate prices don’t always go up, there is a short real estate market for a reason. Recessions can often raise interest rates on mortgages which can make it more challenging for those looking to purchase or invest in a home.

While no industry is completely immune to the effects of an economic downturn, real estate remains a top investment choice for investors looking to build a diversified long-term portfolio.

Parcl Recap

Real estate prices do often decline during a recession, but not usually in a major way.

For investors with significant amounts of capital on hand, a recession can be a great time to invest in real estate.

Dollar-cost averaging into real estate exposure can be a great way to avoid trying to time the market.

A recession can often lead to homeowners selling their home to relocate to a new job or cut costs presenting an opportunity to purchase real estate at bargain prices.

Shared content and posted charts are intended to be used for informational and educational purposes only. Parcl does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages. For more information please see the terms of use.

Parcl Team