Market Update: July 17th 2023

Real estate prices fall MTD, yet Las Vegas, Chicago, and San Francisco buck the trend, showcasing resilience and growth.

Parcl Team

Jul 18, 2023

What Parcl Traders Need to Know

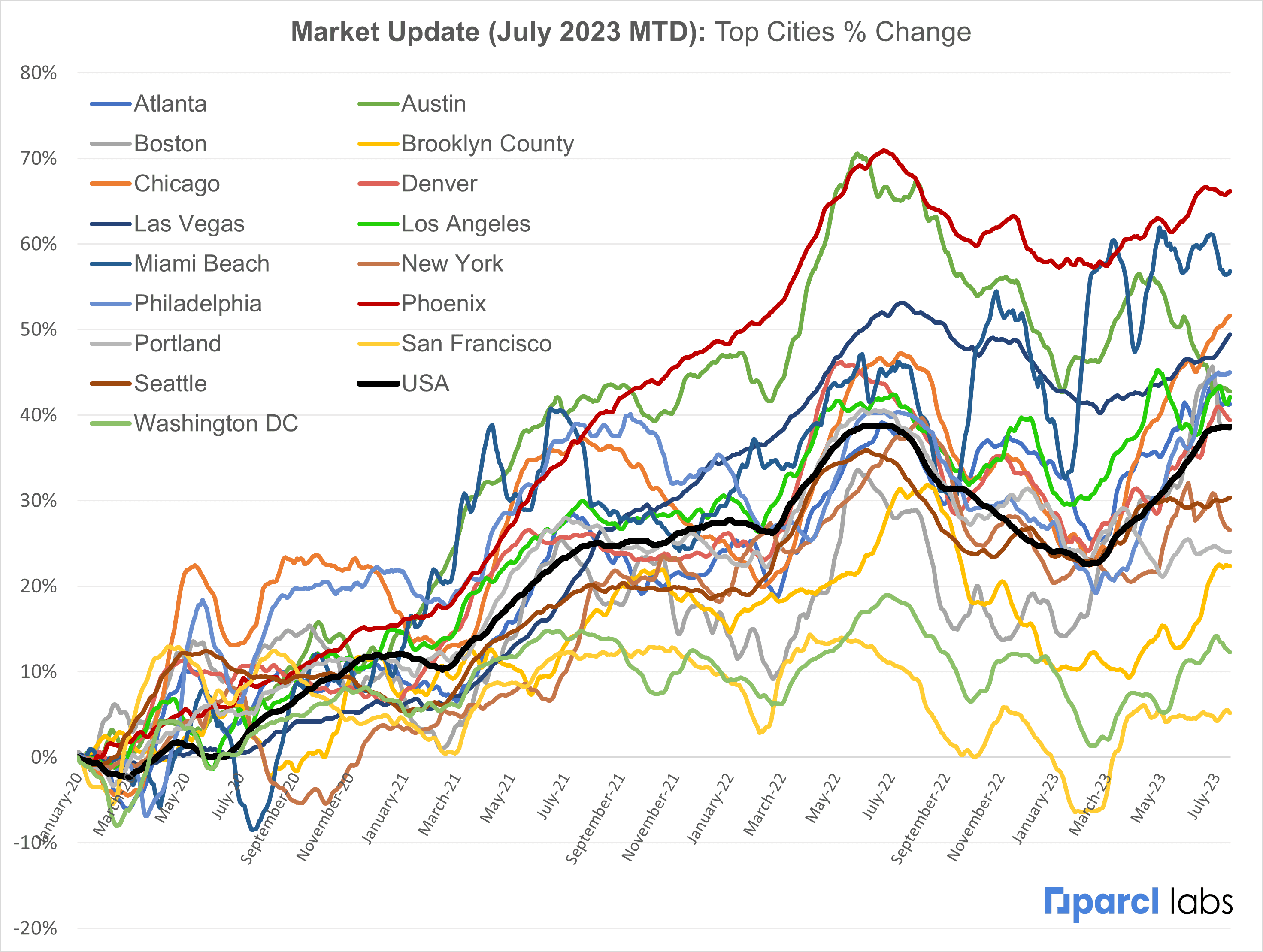

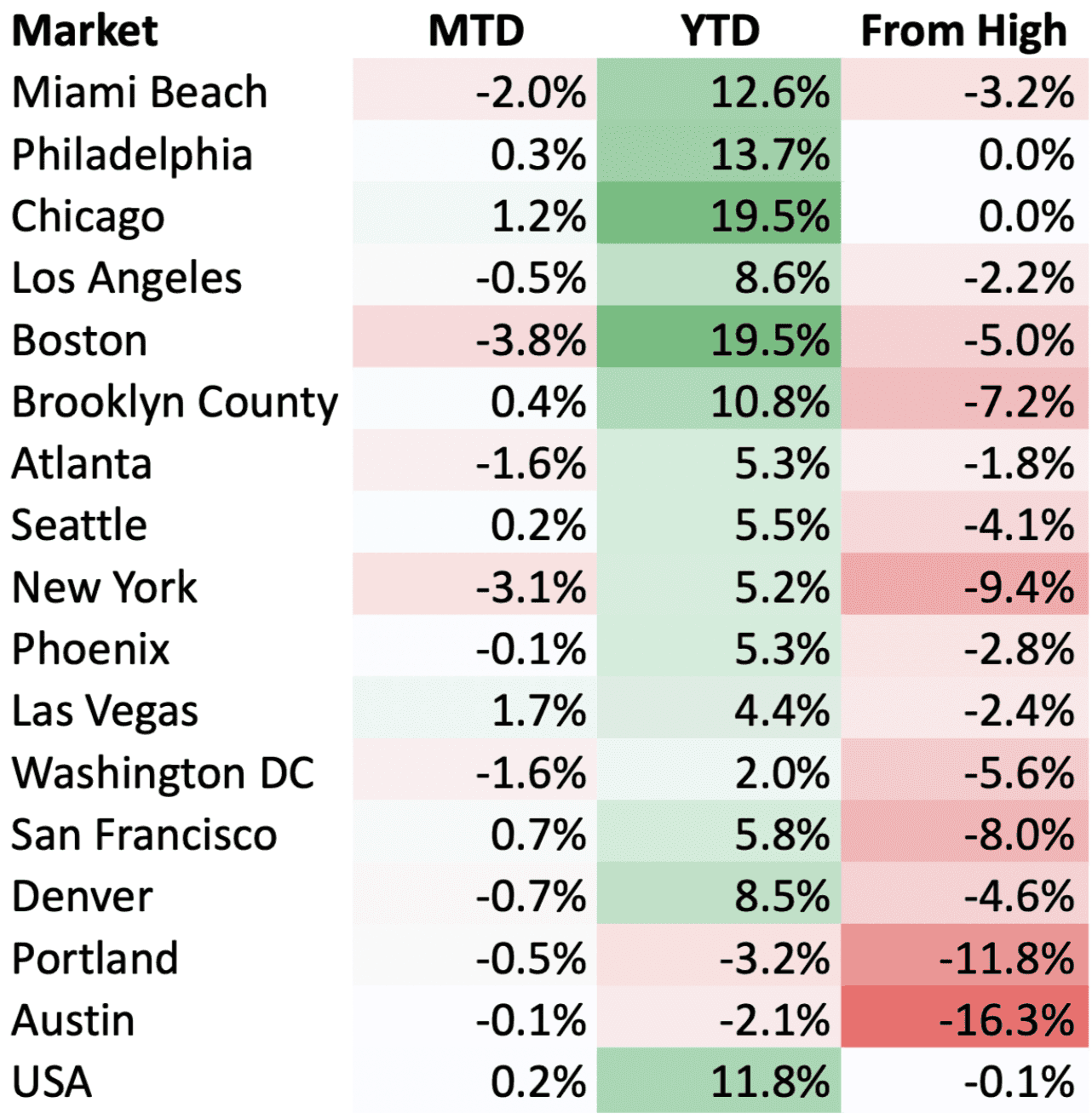

Seventeen tradable Parcl markets are down 0.6% MTD in ppsft terms, compared to June’s 2.2% rise and May's 2.2% gains.

MTD leaders include Las Vegas (+1.7% MTD), Chicago (+1.2%), and San Francisco (+0.7%).

Laggards are East Coast stalwarts Boston (-3.8% MTD), New York (-3.1%) as well as Miami Beach (-2.0%). Boston was a top performing market in June (+5.6%) and tied with Chicago for the top performing market YTD (+19.5%).

Traders are balanced with the aggregate split across all pools 54% long / 46% short. Certain pools are notably skewed, however. Standouts are Brooklyn (~92% long, ~$14k OI) and Denver (~80% short, $13.6k OI).

Total open interest (OI) across all Parcl pools exceeded $200,000 in USDC terms last week; highest OI markets as of July 17th are Brooklyn, Denver, Chicago, and Phoenix. OI now sits at ~$170k, +124% from June’s mid-month update.

Paris and Ile-De-France are the newest tradable markets on Parcl. Stay tuned for more cities coming soon!

The state of real time real estate prices

Residential real estate prices are down 0.6% MTD in ppsft terms, compared to June’s 2.2% rise and May's 2.2% gains.

Month-to-date leaders include Las Vegas (+1.7% MTD), Chicago (+1.2%), and San Francisco (+0.7%). Chicago is tied with Boston for the lead in YTD performance, while San Francisco is towards the middle of the pack at +5.6% YTD, though well below USA at +11.8%. Las Vegas remains in the bottom third in YTD performance terms at +4.4%.

Laggards are East Coast stalwarts Boston (-3.8% MTD), New York (-3.1%) as well as Miami Beach (-2.0%). Boston was a top performing market in June (+5.6%) and tied with Chicago for the top performing market YTD (+19.5%). New York is about average, though still below USA (+11.8%). Miami Beach remains in the top third in YTD performance at +12.6%.

We are observing a continuation of the trend of regional divergence that has persisted for much of the past ~12 months, at all levels of geography (national regions, state vs. state, intra-metro, etc.)

Philadelphia and Chicago remain at all time highs, while the USA price feed is just 0.1% off its all time high, set in July 2022. Four markets remain well off their all time highs: Austin (-16.3% from ATH), Portland (-11.8%), New York (-9.4%) and Brooklyn (-7.2%).

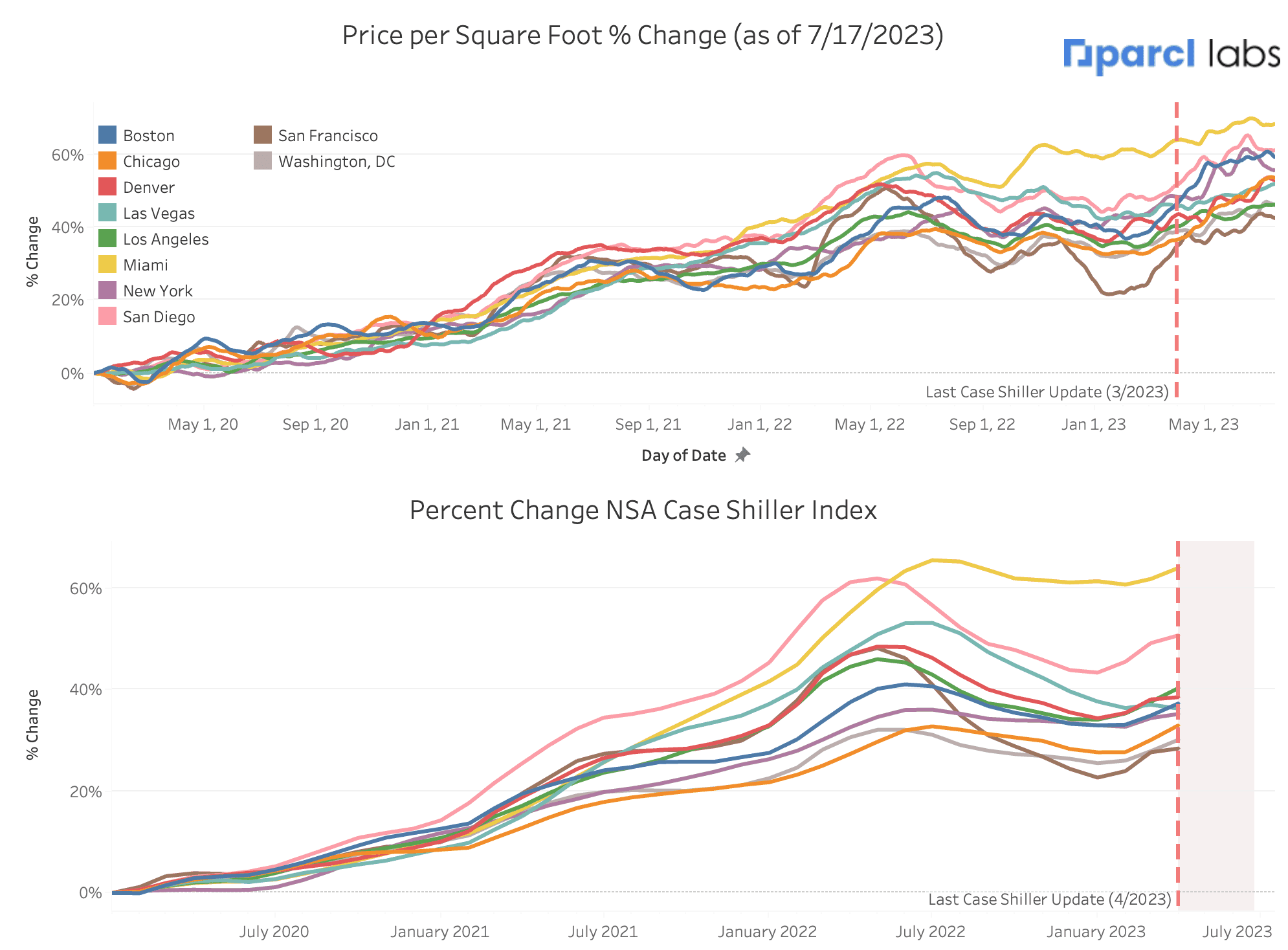

The Case Shiller updated with May data on Tuesday 6/27, showing a continued recovery in prices across all major markets. Real time data from Parcl Labs picked this up as it was happening, and, in the nearly two months since, show a continued but slowing recovery, with many markets up low/mid single digit percent from their end-May marks. This recovery may be nearing a pause or reversal, however, if July MTD performance is any indication. July also marks the tail end of the seasonal outperformance typically seen in many north/northeast markets.

Parcl Team